- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Hedging Resource Center

- Farmer's Almanac

- USDA Reports

- Markets/News

Is Wall Street Bullish or Bearish on C.H. Robinson Stock?

/C_H_%20Robinson%20Worldwide%2C%20Inc_logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

C.H. Robinson Worldwide, Inc. (CHRW), based in Eden Prairie, Minnesota, is a prominent player in global logistics and transportation services. With a market cap of $11.4 billion, it focuses on freight brokerage, supply chain solutions, and third-party logistics (3PL), facilitating connections between shippers and an extensive network of carriers.

Over the past 52 weeks, shares of C.H. Robinson have returned 16%, outperforming the broader S&P 500 Index’s ($SPX) 11.9% rally. However, the stock is down 7.1% in 2025, lagging behind SPX’s marginal dip on a YTD basis.

Narrowing the focus, CHRW stock has also outpaced Pacer Industrials and Logistics ETF’s (SHPP) marginal drop over the past year. But, the ETF’s 2.1% rise on a YTD basis outshines the stock’s single-digit loss in 2025.

CHRW rose over 7% on May 12 as trucking stocks rallied on signs of easing U.S.-China trade tensions. Hopes for improved trade relations boosted investor sentiment, with expectations of stronger freight demand and supply chain activity benefiting logistics firms like CHRW.

For the current fiscal year ending in December, analysts expect C.H. Robinson’s EPS to climb 5.1% to $4.74. The company’s earnings surprise history is robust. It beat the consensus estimates in the last four quarters.

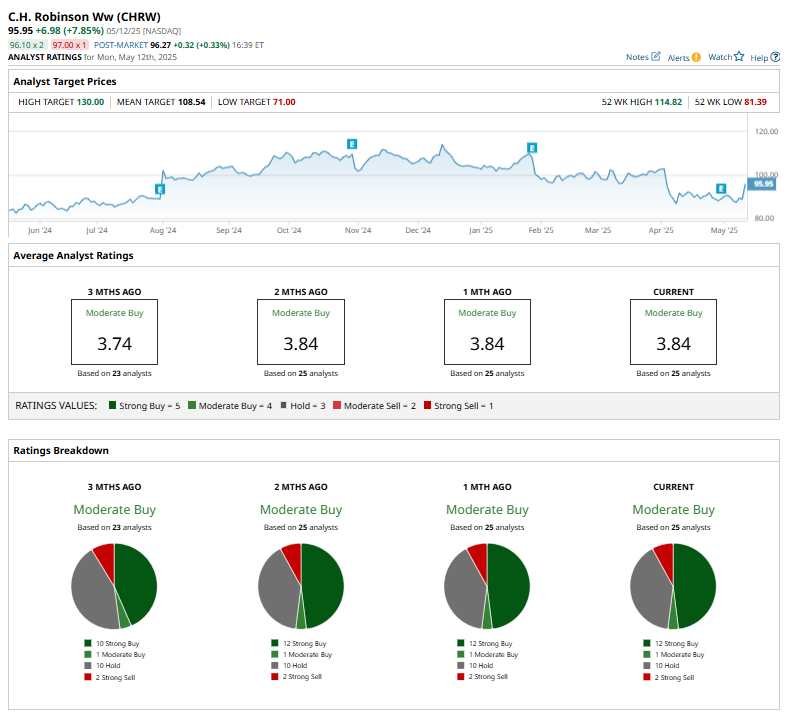

Among the 25 analysts covering CHRW stock, the consensus rating is a “Moderate Buy.” The current rating is based on 12 “Strong Buys”, one “Moderate Buy,” 10 “Holds,” and two “Strong Sells.”

This configuration is more bullish than three months ago, when the stock had 10 “Strong Buys.”

On May 1, 2025, JPMorgan Chase & Co. (JPM) analyst Brian Ossenbeck reaffirmed an "Overweight" rating on C.H. Robinson, signaling continued confidence in the company’s outlook. However, the firm trimmed its price target from $126 to $118.

CHRW’s mean price target of $108.54 represents a premium of 13.1% to current price levels. Further, the Street-high target of $130 suggests a potential upside of 35.5%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.